One of the prominent themes in fintwit these days is inflation and QE (quantitate easing). In this blog, I am capturing my understanding on the topic in (hopefully) simpler terms.

Lemonade Economy

Before we get to inflation, let us try to understand economy through a simple thought experiment.

Lets say, one fine day I get an idea to sell Lemonade in the evenings at a public park new my home. I put in my own money to buy a stand, lemons and equipment needed to make lemonade. This business proves profitable because there are lot of kids who play in this park and they pester their parents for lemonade. It wont be long before I decide to expand this business to two other parks in my neighborhood.

As good as this idea is, it has some limitations. One, I need more capital and two, I cannot be in multiple parks at same time. So I approach a bank and show them my business plan and take a loan. With this money, I buy equipment and supplies needed for additional parks. But, I still did not solve the second problem. How can I be in multiple places at same time? For this I start employing people to run this business in other parks. My business takes off with very good cash flows.

Watching this success, a new entrepreneur decides to put a competing business by selling sugar cane juice in same parks. They go through same process of borrowing from bank, employing people and setting up juice stands. This soon becomes a small economy with money primarily powered by spending.

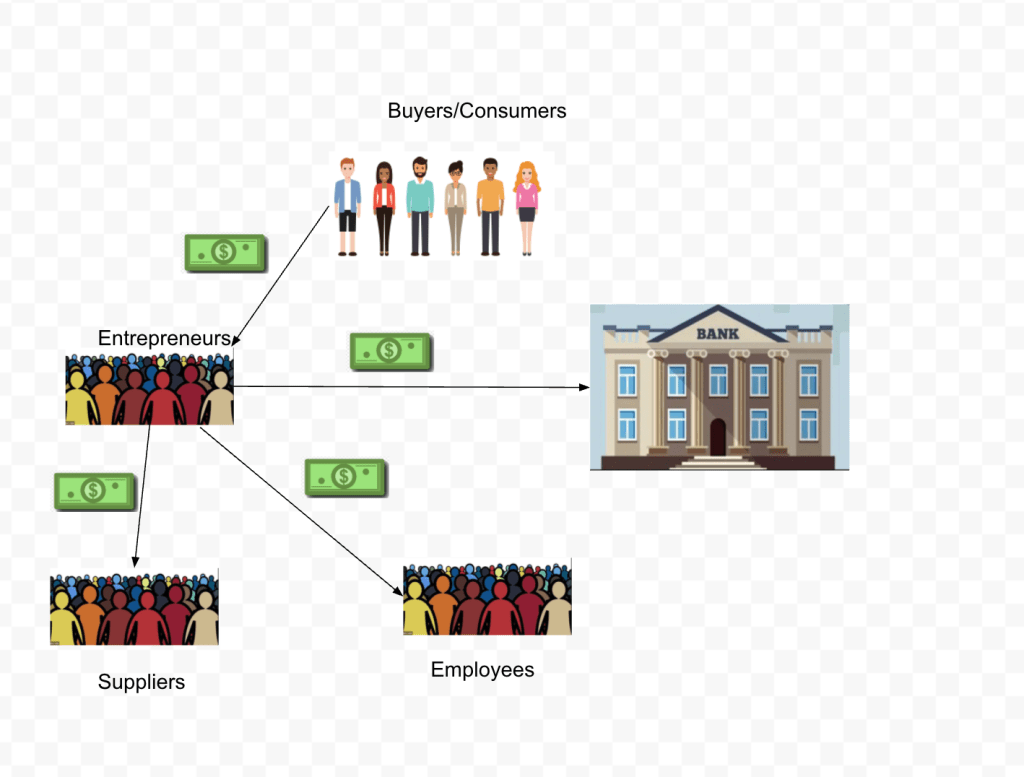

- Parents (buyers) of kids spend their excess cash for refreshments passing money to entrepreneurs.

- Entrepreneurs expand their business through leverage (fancy word for borrowed money), receive money from buyers.

- Bank lends money to entrepreneurs and collects interest payments.

- Employees receive money from employers.

- Suppliers of equipment (lemons, sugar cane, stands) get more revenue for their business.

Important piece to notice here is the total money in this economy has not changed. It just moved from one entity to another. One entity’s spending becomes another one’s income. If the total money in the economy is represented by a pie, the percentage share of each entity has changed.

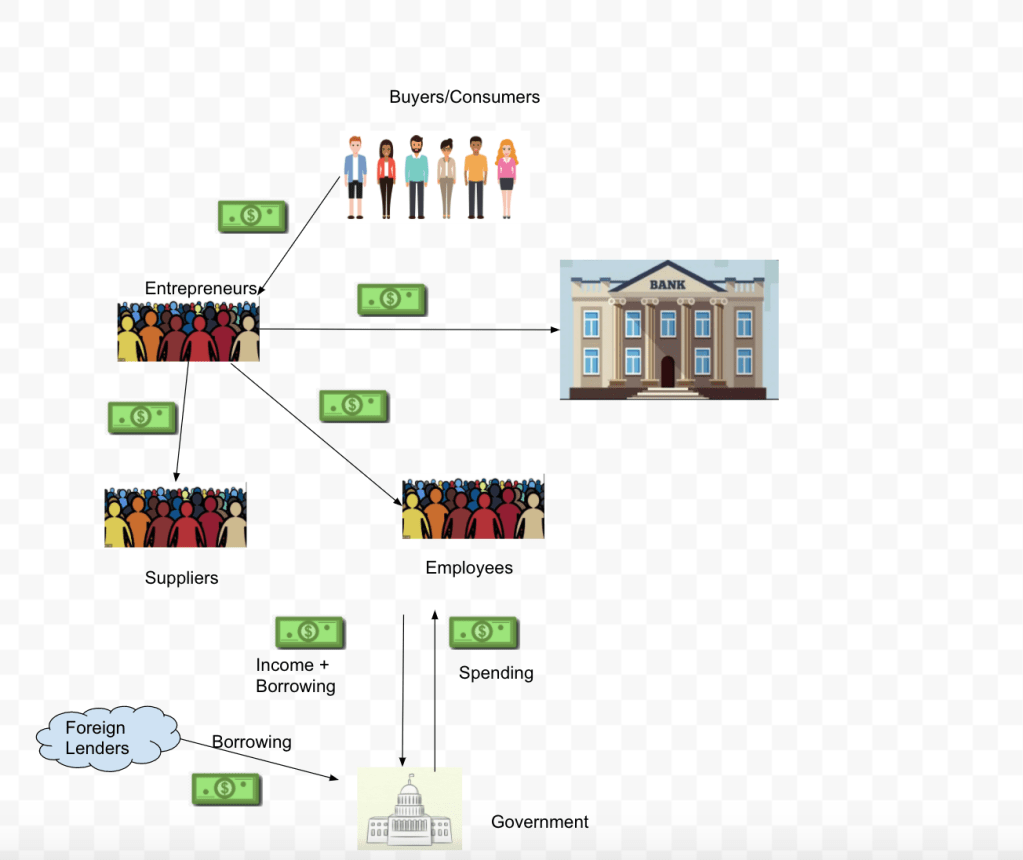

One of the differences between this hypothetical economy and real world is absence of two critical entities – Government & Central Banks. Let us go through their roles next.

Government

In any society in today’s world, government plays a fundamental pillar which keeps the society intact. Its responsibilities are wide ranging like judicial system for basic safety or well being of society, infrastructure – like roads, parks etc, retirement benefits, military expenses etc.

One side affect of these roles is that it also creates employment to people and hence helps economy engine flowing through deployment of money. Government gets this money primarily through taxes (both on income, trade and other forms). In a happy equilibrium government has enough income to fund its expenditures. But sometimes government need more money than it needs. Let’s say to fund a huger rail system construction which needs capital upfront. Or a far less desirable reason – wars.

Just like entrepreneurs in our example government has to resort to borrowing money. This borrowing can be done in multiple ways. Two popular ways are:

- Issuing bonds (which is a promise to payback later)

- Using Quantitate Easing

Issuing Bonds

In this method, government can simply issue a contract – which requests for some amount money with a promise to payback in some number of years with a certain interest rate. Government can they shop this around to lenders. In United states these are referred to as Treasury securities. Lenders could be anyone – an investor looking for a safe way to invest this money or a foreign government who has excess income and wanting to invest. It is important for government to use both forms.

Borrowing always from lenders in country is not feasible. Also, it doesn’t get new capital in the country. Rather, it just moves total money in the country around. On the other hand, borrowing from other nations and foreign investors creates additional influx of money. This could help power the economy, increase productivity, generate more goods and potentially export them, thus generating more money inflow.

If governments are not careful in their spending, soon this could lead to irrecoverable spiral. For ex unexpected costs like wars or change in tax policies or pandemic will lead to more borrowing. Over a period of time, government’s balance sheet becomes lop sided and with it its ability to repay accrued debt soon vanishes. This can lead to lack of enough lenders to fund additional debt to run the government. At this point, governments have to resort to another mode of funding – Quantitive Easing.

Quantitave EASING

Before discussing this, we need to introduce another entity economic system – Central Banks. Central banks (Federal Reserve in USA) is the sole authority that manages monetary policy in a country. Among other things, one major responsibility that it fulfills is managing production of money in the country. In other words, it prints the money.

One form of quantitative easing occurs when government issues more bonds but instead of selling to investors, it sells it to Central bank. Where does central bank get this money? It just prints it. This transaction doesn’t occur in such straightforward way. It is done through intermediaries. But what matters is, at the end these bonds appear in balance sheet of Central bank and government gets the money it needs. So government can get to spend more money without extracting it from investors or foreign lending. This in itself should cause a drop in value of each individual unit of money.

For example, before printing new money if there are total 100 notes in circulation and total value of those 100 notes is 100000. Then each note is worth 1000. But if you suddenly have 110 notes in circulation but total value of goods and services in country hasn’t changed. Then each note is worth 100000/110 = 909.90.

Astute reader may point out that this is not a problem, if those additional 10 units are distributed evenly to everyone. It is true, but in realty that does not happen. In practice not all of those additional money printed gets sent to people. Instead of some of them is used to cover additional expenses of government (isn’t it why it borrowed in first place?), or to power unemployment benefits during time of recession etc. This means that some people have to take a hit in terms of value lost on the cash they hold.

Apart from this form of QE, there are other times in which Central Bank prints money. For example, Central banks in past have printed money to not just buy Treasuries but to also buy bonds issued by other Corporations. This happened during 2009 financial recession and in the current Covid-19 powered recession.

So, in these cases newly minted money is not sent to common person through government. But rather it is sent into financial markets. This causes asset (stocks) prices to rise which benefits people who have luxury to invest in financial markets. These people will see their net worth raise. These people have more money to spend than they would have had otherwise.

This leads us to our next topic – Inflation.

Inflation

All this new money flooding into the system means there are more dollars chasing same number of goods and services. In a free market this causes rise in the prices. This is referred to as inflation – the reduction in purchasing power of each unit of money.

Government has a mechanism to track this rate of price increase. The official term for this is Consumer Price Index. They take a basket of goods that are usually purchased by households and track the price of this basket over a period of time. This is generally what people mean when they say inflation is 2% or 3%.

But there are some flaws in judging outcome of monetary policies purely through lens of CPI. One of them is that it is managed by government and often items (or their proportions) considered in these basket change.

The other is, prices of goods are affected by forces other than money printing. For example in his book – The Price of Tomorrow, Jeff Booth explains how deflationary force of technology causes the prices to go down. Technology and innovation helps us produce goods and services at cheaper price and faster pace. These savings are passed on to consumers causing reduction in prices (deflationary). So, the real downsides from money printing are hidden by these deflationary forces.

Also CPI doesn’t really capture other expenses that are incurred by households. Take College eduction for example. This article by CNBC, cites that college education increased by 25% over last 10yrs. Or this article by Forbes, which says college education rate is growing at faster pace than wages. You will find similar stories for Health care. So while wages increasing at a very marginal rate, these expenses are accelerating.

This puts a massive pressure on majority of population. Education and financial markets are essential ways of upward mobility. Over time it is increasingly difficult for masses to get access to these opportunities, essentially leading to a two class system. No wonder despite a historical bull run in economy over last 10yrs, more and more people feel left out. The system is failing them.

This is very well articulated in this following twitter thread by @PrestonPysh.

Conclusion

No matter where in political spectrum between Capitalism and Socialism one lies, there seems to be enough evidence that current monetary policies and particularly QE seems to have unintended affects. It is driving higher inequality, more polarization, emergence of two class systems and increasing loss of confidence in the fiat monetary system. It is an extremely complex subject which I hope to continue learning about.